The end of earnings season is always a good time to take a step back and look at who shined (and who didn’t so much). Let’s take a look at how casino operator stocks fared in the fourth quarter, starting with PENN Entertainment ( NASDAQ:PENN ) .

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Ever heard the expression “the house always wins”? The regulation cuts both ways, however, and casinos may face the risk of a stroke of the pen that suddenly limits what they can or cannot do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences such as the ability to bet anywhere on demand.

The 8 casino operator stocks we track reported a weaker quarter; on average, earnings beat analysts’ consensus estimates by 1.1% Stocks have been under pressure as inflation (despite slowing) makes their old earnings less valuable, but shares of casino operators held up better than others, with share prices up 4.2% on average since previous earnings results.

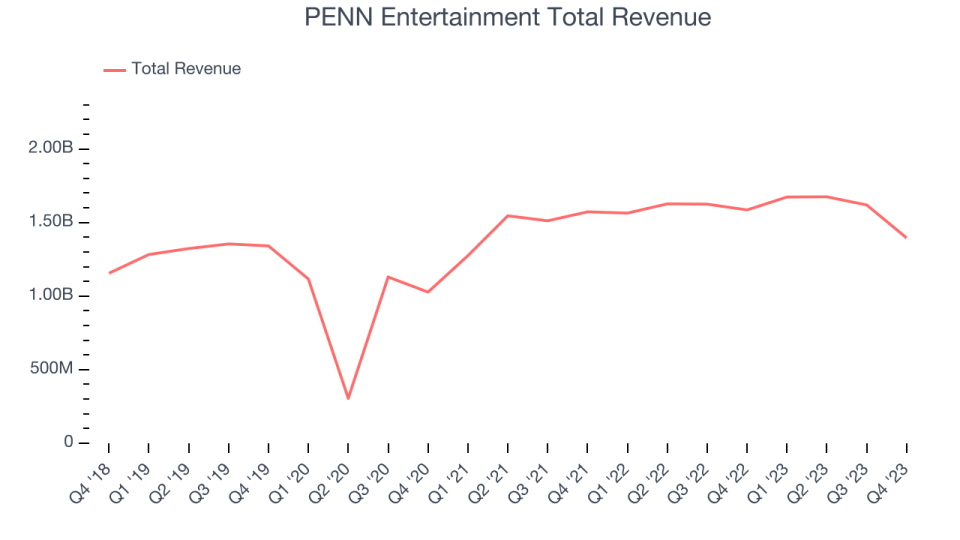

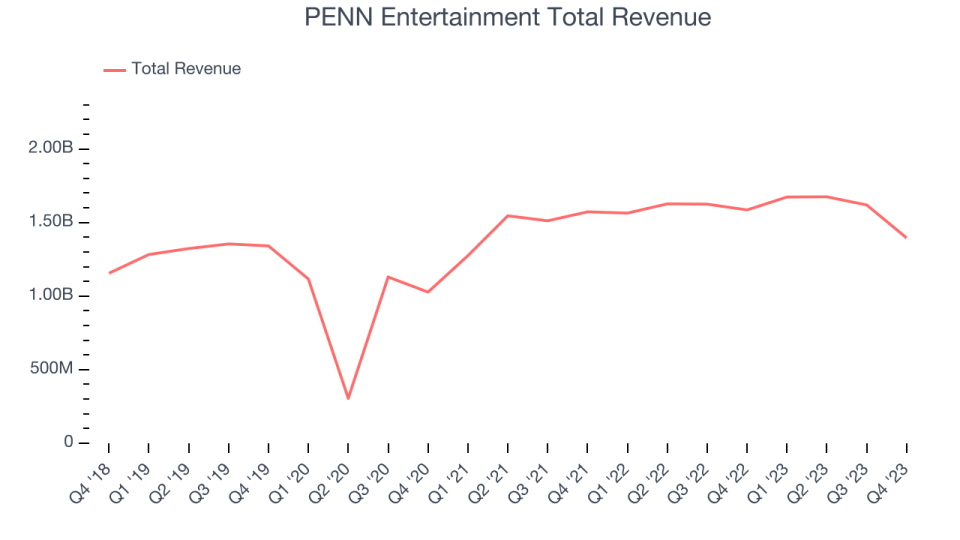

Q4 Weakest: PENN Entertainment (NASDAQ:PENN)

Founded in 1982, PENN Entertainment (NASDAQ:PENN) is a diversified American operator of casinos, sports betting and entertainment venues.

PENN Entertainment reported revenue of $1.40 billion, down 12% year-over-year, falling short of analysts’ expectations of 9%. It was a weak quarter for the company, missing analysts’ revenue estimates and missing analysts’ operating margin estimates.

Jay Snowden, Chief Executive Officer and President, said: “PENN delivered another quarter of ownership-level performance while continuing to invest in our high-growth digital business, which we believe will create significant long-term shareholder value . Our retail results reflect strong customer demand and well-executed strategies across our portfolio. In our Interactive segment, ESPN BET attracted significantly more first-time depositors (FTDs) than we expected, which drove higher-than-expected promotional spend. Our successful launch led to significant expansion in key performance indicators (KPIs) including monthly active users (MAUs), handle and money delivery. Importantly, strong early retention and continued user acquisition have led to steady month-over-month growth in cash handling as our promotional spend begins to normalize entering 2024. ESPN BET has also attracted fans of mass market sports, highlighting the potential to broaden the appeal of sports betting and grow the overall market. This foundation creates the foundation for continued growth and market share gains as we introduce further product enhancements and deeper integrations into the ESPN media ecosystem.

PENN Entertainment underperformed against analyst estimates of the entire group. The stock is down 21.7% since the results and currently trades at $17.6.

Read our full report on PENN Entertainment here, it’s free.

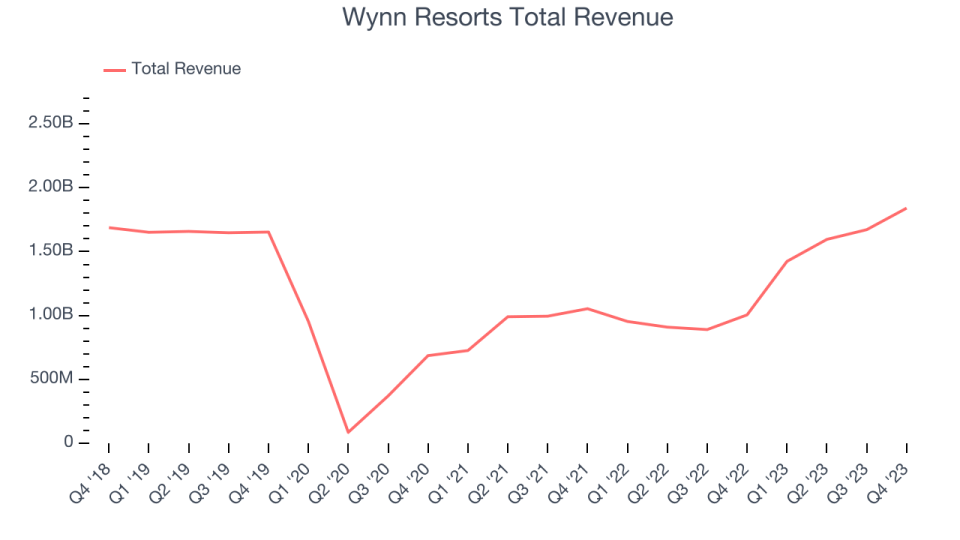

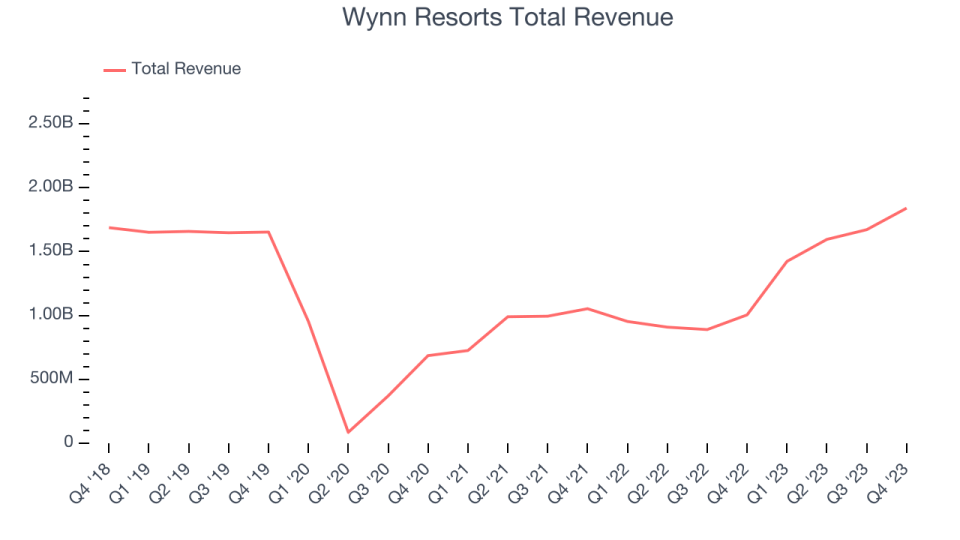

Best Q4: Wynn Resorts (NASDAQ:WYNN)

Founded by the former CEO of Mirage Resorts, Wynn Resorts (NASDAQ:WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxury properties and premium guest services.

Wynn Resorts reported revenue of $1.84 billion, up 83.1% year-over-year, beating analysts’ expectations by 5.9%. It was an amazing quarter for the company, with an impressive pace of analyst earnings estimates and an impressive pace of analyst operating margin estimates.

Wynn Resorts delivered the fastest revenue growth among its peers. The stock is up 5.2% since the results and currently trades at $105.01.

Is now the time to buy Wynn Resorts? Access our full earnings results analysis here, it’s free.

Bally’s (NYSE:BALY)

Headquartered in Providence, Rhode Island, Bally’s Corporation (NYSE:BALY) is a diversified global casino entertainment company that owns and operates casinos, resorts and online gaming platforms.

Bally reported revenue of $611.7 million, up 6.1% year-over-year, falling short of analysts’ expectations of 1.8%. It was a weak quarter for the company, missing analysts’ operating margin estimates and missing analysts’ earnings estimates.

The stock is up 32.7% since the results and currently trades at $13.67.

Read our full analysis of Bally’s results here.

Caesars Entertainment (NASDAQ:CZR)

Formerly Eldorado Resorts, Caesars Entertainment ( NASDAQ:CZR ) is a global gaming and hospitality company that operates multiple casinos, hotels, and resort properties.

Caesars Entertainment reported revenue of $2.83 billion year over year, falling short of analysts’ expectations by 1.3%. It was a weak quarter for the company, missing analysts’ earnings estimates and missing analysts’ operating margin estimates.

The stock is up 5.5% since the results and currently trades at $43.96.

Read our full and actionable report on Caesars Entertainment here, it’s free.

Golden Entertainment (NASDAQ:GDEN)

Founded in 2001, Golden Entertainment (NASDAQ:GDEN) is a gaming company that operates casinos, taverns and distributed gaming platforms.

Golden Entertainment reported revenue of $230.7 million, down 17.5% year-over-year, falling short of analysts’ expectations of 1.4%. It was a weak quarter for the company, missing analysts’ operating margin estimates and missing analysts’ earnings estimates.

Golden Entertainment had the slowest revenue growth among its peers. The stock is down 4.6% since the results and currently trades at $35.32.

Read our full and actionable report on Golden Entertainment here, it’s free.

Join the paid stock investor search

Help us make StockStory more useful for investors like you. Join our paid user research session and receive a $50 Amazon gift card for your thoughts. Register here.